Anyone catch the speech that whoever is actually running things gave Biden to say? I swear that this political climate is starting to look like the opening chapters of ‘Atlas Shrugged’. I suspect it’ll start drifting towards the first 3/4ths of “The Mandibles” (recommended) before we’re through. Trillions of dollars. Just for fun, a dollar bill is about 6.14″ long. If you lined a trillion dollar bills up end to end, the line would be a bit under 97,000,000 miles…thats about 3900 times around the earth. Here’s better perspective. Or, put another way, if you literally took every single bit of US currency around the world and put it into .gov’s hands, that’d be about $1.2 trillion.

So, what you’ve got is a guy who wants to spend more cash than actually exists. He could literally take all the currency that exists and it would still not pay for the things he wants.

Kinda hard to wrap your head around that, isn’t it?

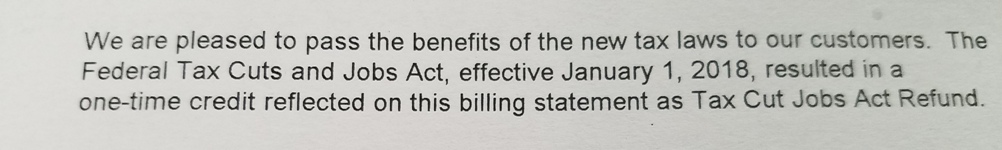

Fortunately, as I understand it, the money (such as it is) is simply created with a push of the button. No need to pull the cash out of every person’s wallet. Yet.

Here’s the part I don’t understand: When Robert Mugabe prints physical money to fund his government, hyperinflation results. When the US .gov does it electronically instead of physically, we get….minimal inflation? Something doesn’t connect for me there.

The old expression is “All politics is local”. You may not understand, care, or feel that the consequences of this sort of economic behaviour will affect you. National debt? Thats a national problem. But when your paycheck gets smaller as taxes go up, as your purchasing power goes down, as economic growth slows and jobs fade, as .gov handouts pile up and people no longer want to work…then you’ll notice. And then it’ll be too late to prepare.

I’ve no crystal ball. What I do have, though, is a unique perspective and outlook. Sometimes it works for me, sometimes it doesn’t. But I’m never sorry when it pushes me towards caution, since I’ve regretted too little caution far more often than I’ve regretted too much caution. And now, it’s pushing me towards caution. So be it. If I’m right, I fare better than most. If I’m wrong, all I’ve done is build up a diverse store of assets and experienced some opportunity cost.

Will we be hauling around money in wheelbarrows eventually? Nah. I just can’t see that happening. But, here’s an interesting blog post about if that whole ‘wheelbarrows of money’ thing was actually real.