Originally published at Notes From The Bunker. You can comment here or there.

Note: A followup to this post can be found here: A Month Of Living On A Zero-Based Budget – Pt. II

If you really think about it, preparedness comes down to several key functions. One of those functions is resource management. What is resource management? Resource management is making the most efficient use of the resources available to you while conserving, preserving, managing, maintaining and monitoring those resources for future usage. Or, to cut it down into a one-word definition that doesnt quite fit, resource management is largely about budgeting.

We know that after a major crisis the most valuable resources we have are the things we need for our survival, safety , and continued comfort, right? We want food, water, shelter, light, heat, medical attention, security, communications, and that sort of thing. Once the crisis starts our opportunity to acquire those things through ‘conventional means’ (like driving down to CostCo) is usually limited or completely unavailable. Thus, after a crisis, what you have at that moment is one of your most valuable resources. (Not the most valuable resource, but one of them.) Managing those resources becomes one of your key preparedness skills and objectives….after all, you can’t just crack open all your MRE’s and have a party for the neighborhood and expect to have something to eat the next day. You have to manage, or ‘husband‘ as they used to say, your resources so you always have options.

What is your most valuable resource before a crisis? Well, this is just an opinion, but it seems to me that your most valuable resource before a crisis is whatever enables you to get all the resources you’ll need for after the crisis. Currently, in our fairly moderately-civilized clime, the most valuable resource at the moment is money. Money is, if you think about it, an amazing multitiool of concentrated energy. Trouble is, most folks seem to handle their money poorly…and the missus and I were pretty much in that group. Oh, the bills got paid, we had our enjoyments, and we were never hungry…but we weren’t getting as much put away for a rainy day or for goals in the future. So, for the month of July, we decided to live on a zero-based budget. A zero-based budget means that you know you’re going to earn ‘x’ amount of dollars that month, so you write up a budget that spends every dollar of that amount. When you subtract how much you spent from how much you made, the answer should be zero. If your answer is a positive number, that means you didn’t plan propely where all your money should go, a negative number means you overspent.

Lemme give you a very stripped down example. Lets say you bring in $2000 in a month. Once you subtract everything you plan on doing with that money, you should have $0 left. You might think “$500 for rent, $100 saving, $100 auto expenses, $300 groceries, $100 entertainment….”, etc, etc, until you’re down to zero. Thats a zero-based budget. If you wind up needing more money for auto expenses you have to pull it from somewhere else…like groceries or entertainment. If you need an extra $25 for gas that month you’re gonna have to live with $25 less entertainment or something….but all the numbers need to add up to zero.

So, we decided to give it a shot and see how it would work out. We knew that there was a good bit of impulse buying in our behaviors and that sort of thing. We wrote up a budget, made a stack of envelopes with each one labelled with its purpose (‘groceries’,’fuel’,’dog expense’,’dining out’,’entertainment’, etc, etc, etc.) and put the cash into the envelope that was allocated to that function. Going to go put gas in the truck? Take $20 from the ‘fuel’ envelope and put gas in truck. Ordering pizza? Take $10 from the ‘dining out’ envelope and go get the pizza. What if we burned through the ‘dining out’ envelope and still want a pizza? Well, you can take $10 from a different envelope but that means you have to deal with $10 less in that envelope’s subject…maybe pull $10 from ‘groceries’, and now we have $10 less for groceries that month. So you have a definite interest in staying on your budget as well as creating a realistic one. Savings came off the top…in this case 25% went right into savings via direct deposit…so it was easy to pretend it wasnt even there. The remaining 75% gets budgeted to take care of us for the month of July. (And, yes, you could simply use a debit card and keep track of things rather than having cash segregated into envelopes but there’s a very emotional component of spending cash that just isn’t there when using plastic…fishing $20 out of your pocket and watching it disappear makes you much more careful about how you spend it than a piece of plastic does…thats why they give you chips to play with in Vegas rather than cash.)

What did that mean for average day-to-day living? Well, it required a bit of impulse control. There was about $10/day budgeted for ‘spending money’, but you couldnt spend more than that without repercussions. Want to buy a pair of $295 boots? Go ahead, but then you have only five bucks pocket money until the end of the month…so weigh your choices. Grocery shopping meant actually doing some math and comparing prices, which is something I’ve always done but was something the missus never really showed too much interest in. And, yeah, there was a little grumbling about ‘why shouldn’t I be able to just drop $100 on [item] if I want’? But, having stuck with the budget for a solid month, we have more money in the bank at the end of the month than if we had not. And we have a better idea of how much we spend and on what. Previously, like many folks, money got spent like this: pay the bills, buy groceries, whatever is left is free to spend. Sadly, that’s not a really good plan.

Several of you reading this are going to say “Hey, this sounds really familiar” and it should, it is pretty much exactly what Dave Ramsey promotes on his radio show. I’m not a Kool-Aid drinker by any stretch, and I disagree with him on a couple things, but the zero-based budget part and the ‘baby steps‘ are probably the two things about this guy’s money-handling philosophy that I can wholeheartedly endorse. I can endorse it because, for us, it works. We have no debt except the mortgage, we have an amount of money on hand for emergencies, and by following a budget (which really isn’t confining or restrictive if you plan it right and keep your eyes on the big picture) we’ll have a much larger emergency fund (six months of expenses) socked away so that if, Crom forbid, something ugly happens we’re in a position to ride it out. Example: our water heater went Tango Uniform a couple years ago. Not cheap to replace. But, since we had a bunch of cash set aside for emergencies we just went ahead and had the new one put in immediately…with no hiccup to our day-to-day finances. That emergency fund was then replenished from monies that would have been directed into savings over the next few months. No crisis.

Now at this point I’m sure a couple folks are trying to see how this ties into the general theme around here of preparedness. Let’s say the monhtly income around here is ‘x’, and once savings are taken into account there is 3/4 of x to use for a budget.Preparedness becomes part of the budget. There can be an envelope somewhere marked ‘storage food’ or ‘preparedness’ and you can budget whatever amount you want for it (as long as your overall budget still zeroes out). So, maybe instead of dropping $500 into savings every month, $200 into dining out, $100 into entertainment and $100 into a vacation fund you decrease each one of those by, say, $20….and you now have a new budget item of ‘preparedness’ and $80 to spend every month on it (or carry that $80 to the next month to buy bigger-ticket items) and your budget still comes out to zero.

One of the biggest reasons people give for not preparing is that they say it’s expensive or they just don’t have the money. By budgeting, and sticking to that budget, it’s amazing how much money you find that you actually have. If you dont think so, try this experiment..think about how much money you made last month, now try to think where it all went. At some point you’ll come up with a number short of the amount you made and figure “I have no idea where the rest of it went”…see, thats how you wind up not having enough resources to do the things you want.

One big facet of preparedness is resource management. For us, money is another item or resource to have in place against that upcoming Rainy Day….right up there with the cases of Mountain House, South African ball, jerry cans of fuel, and MagLites. The best way that we’ve found, for us, to husband this resource is through the method above. Might work for you, might not. But even if it doesn’t, that doesnt mean it isnt a good idea…it just means you might need a different method.

I’m already 50% past my usual self-imposed limit of 1000 words but I should mention that this months experiment in budgeting would have been completely impossible without the amazing self-discipline of the lovely missus who really threw herself into this experiment. I was curious about her opinions about this months experiment….she said that while there were moments where she didn’t like feeling she couldn’t spend money on something, she did like the fact that at the end of the month we had more money in the bank than in the months where we didn’t budget. And she’s a smart enough gal to have an eye on the big picture…a little dissatisfaction in the short term from having to deny yourself something is worth the payoff of later on being able to do things you really want to do. And, of course, she likes the security of having a wad of cash available in case theres an emergency.

So there you go…one month on a zero-based budget. We both think it was a successful experiment and this months budget will get a little tweaking here and there but otherwise, we think it was a great success.

Strongly suggested reading: The Total Money Makeover: A Proven Plan for Financial Fitness. This is the book that lists out everything mentioned above, provides worksheets and templates for budgeting, and is just generally an excellent motivator. Be warned there are some religious themes in there, but they can be ignored without detracting from the contents.

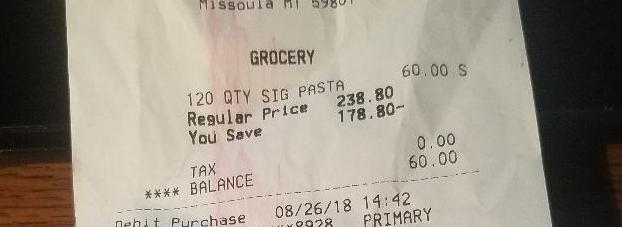

Shopping carts are for amateurs. When the Zero stocks up, he goes deep.

Shopping carts are for amateurs. When the Zero stocks up, he goes deep. This doesn’t mean you shouldn’t put money away as part of your preps…it just means that you need to think about things past the obvious. Maybe you already do that..I didn’t used to. Preparedness is really about resource management in regards to risk reduction – we try to get the most for our money when we take steps to protect ourselves from future problems.

This doesn’t mean you shouldn’t put money away as part of your preps…it just means that you need to think about things past the obvious. Maybe you already do that..I didn’t used to. Preparedness is really about resource management in regards to risk reduction – we try to get the most for our money when we take steps to protect ourselves from future problems.